Expertise From A Former IRS Agent

Tax Preparer in Nashua NH

Tax Preparation

IRS Audit Assistance

Bookkeeping

Clear Financial Organization

Dependable Tax Filing Services

Designed For Local Needs

About J&C BalanceWorks

Clients looking for a tax preparer in Nashua NH trust J&C BalanceWorks for organized bookkeeping and dependable financial support. We ensure records are complete, accurate, and ready for filing—helping reduce stress and avoid surprises at tax time.

Featured Services

Bookkeeping Service

Reliable and precise bookkeeping service is essential for staying organized, compliant, and financially informed.

Tax Preparation

Preparing taxes correctly and on time can make a significant difference in both compliance and peace of mind.

Tax Consultation

Getting the proper guidance during tax season can save money, reduce stress, and help avoid costly mistakes.

Why Choose Us

A Personal Approach To Tax Care

We handle your taxes with honesty and dedication.

Leadership With Strength And Clarity

Our women-owned firm provides focused and reliable guidance.

Certified Accuracy From Start To Finish

We ensure dependable tax preparation every step of the way.

What We Offer

- NMonthly Bookkeeping & Cleanups

- NJob Costing & Project Tracking

- NBusiness & Personal Tax Filing

- NQuickBooks Setup & Support

- NAudit Prep & Strategy Sessions

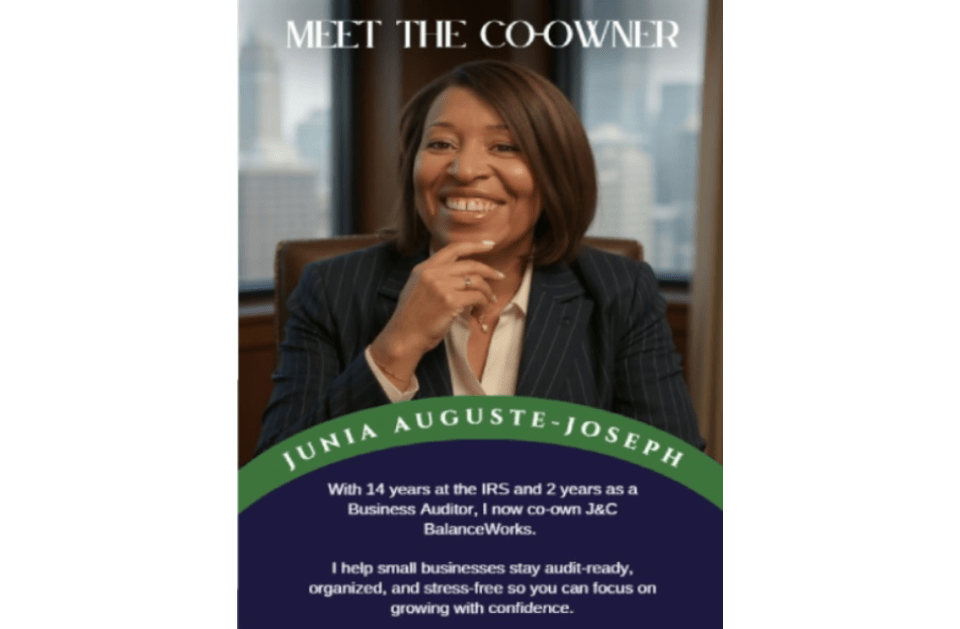

Meet The Experts Behind J&C BalanceWorks

Junia

I spent 14 years with the IRS, most recently working as a Business Tax Auditor. In that role, I closely reviewed company financials to ensure taxes were reported accurately and paid correctly.

Colette

I help individuals and small business owners gain control of their finances. I specialize in bookkeeping service, tax preparation, and personalized guidance as a dedicated tax consultant.

What Customers Are Saying

Michelle P.

“J&C BalanceWorks is a reliable tax preparer in Nashua NH.”

Sarah V.

“Junia handled our filing as a trusted tax preparer in Nashua NH.”

Tom H.

“Colette is a knowledgeable tax preparer in Nashua NH.”

Gallery

Reliable Tax Preparer in Nashua, NH

If you need a professional tax preparer in Nashua, NH, J & C BalanceWorks provides dependable tax filing and advisory services. We help you prepare your return accurately while identifying deductions that apply to your situation. From simple individual returns to complex business filings, our Nashua team ensures a stress-free and efficient tax preparation process.

FAQs

What does a tax preparer in Nashua NH do?

J&C BalanceWorks, a tax preparer in Nashua NH provides monthly bookkeeping, tax preparation, QuickBooks Online setup, cleanup services, reconciliations, financial reporting, and small-business consulting. We help businesses stay organized, accurate, and IRS-ready.

Can a tax preparer in Nashua NH handle state taxes?

Yes, state and federal filings are handled.

Is a tax preparer in Nashua NH good for businesses?

Yes, businesses are supported.

When should I contact a tax preparer in Nashua NH?

Before filing deadlines.

Why choose a local tax preparer in Nashua NH?

Local knowledge improves compliance.

How do I find a local trusted tax preparer near me in Nashua, NH?

To find a trusted tax preparer near you in Nashua, choose a professional with experience in both federal and state tax filings and strong client reviews.

Do you offer virtual or remote bookkeeping?

Yes! J&C BalanceWorks provides 100% virtual bookkeeping for clients across Massachusetts, New Hampshire, and nationwide. You can upload documents securely, and we handle the rest.

What makes J&C BalanceWorks different?

We’re led by a former IRS Revenue Agent with 14+ years of experience, which means your books are handled with expert accuracy, compliance, and audit-ready standards. We bring big-firm knowledge with small-business care.

Can you fix messy or behind bookkeeping?

Absolutely. We specialize in QuickBooks cleanup for Massachusetts and New Hampshire small businesses, including past-due reconciliations, uncategorized transactions, and account corrections whether you’re 1 month or 2 years behind.

How much do your bookkeeping services cost?

Our monthly packages typically range from $300–$3,000+ based on your number of transactions, bank accounts, and business complexity. Custom quotes are available for businesses in MA, and NH.

Can you help set up or fix QuickBooks Online?

Yes. We offer QuickBooks Online setup, troubleshooting, account syncing, and training. Many clients come to us after struggling with bank feed issues, miscategorized transactions, or incorrect setup.

How can I schedule an appointment with you?

You can call 978-200-3331, message us directly on Google, or book a consultation through our website. We offer flexible scheduling for clients in MA and NH.

Do you offer services to new or small businesses?

Yes! Whether you’re a brand-new startup or an established business, we help you set up strong financial systems, understand your numbers, and grow with confidence.

How does J&C BalanceWorks help businesses grow?

We provide clear financial reports that show where your money is going, identify areas to save, and help you plan for taxes. Clean books lead to better decisions, better profits, and better growth.

Local Tax Preparer Near You, Serving Nashua, NH

Searching for a tax preparer near you in Nashua NH? We deliver dependable, timely service. Our tax preparer in Nashua NH offers accurate federal and state tax filings with personalized care.