Expertise From A Former IRS Agent

IRS Services in Massachusetts

Tax Preparation

IRS Audit Assistance

Bookkeeping

Streamlining Your Numbers With Expert Tools

Making Tax Time Simple And Strategic

Fueled By Entrepreneurial Spirit

About J&C BalanceWorks

At J&C BalanceWorks in Lowell, MA, we provide expert bookkeeping service that helps small business owners, solopreneurs, and professionals stay focused on what they do best. As a QuickBooks Certified, certified professional, we deliver accurate, organized, and easy-to-understand records, giving you a clear picture of your business's financial health.

Whether you're behind on books or need support preparing for year-end, our team ensures your accounts are current and audit-ready. We're here to make sure the numbers make sense—without the stress.

Featured Services

Bookkeeping Service

Reliable and precise bookkeeping service is essential for staying organized, compliant, and financially informed.

Tax Preparation

Preparing taxes correctly and on time can make a significant difference in both compliance and peace of mind.

Tax Consultation

Getting the proper guidance during tax season can save money, reduce stress, and help avoid costly mistakes.

Why Choose Us

Giving Every Client The Care They Deserve

As a proud family-owned business, we treat your financial needs like our own—with honesty and dedication.

Leading With Clarity, Heart, And Expertise

Being women-owned means we lead with intention, detail, and strength to elevate your business.

Proudly Delivering Accuracy You Can Trust

We bring certified knowledge to every client, ensuring your bookkeeping service is handled with absolute precision.

What We Offer

- NMonthly Bookkeeping & Cleanups

- NJob Costing & Project Tracking

- NBusiness & Personal Tax Filing

- NQuickBooks Setup & Support

- NAudit Prep & Strategy Sessions

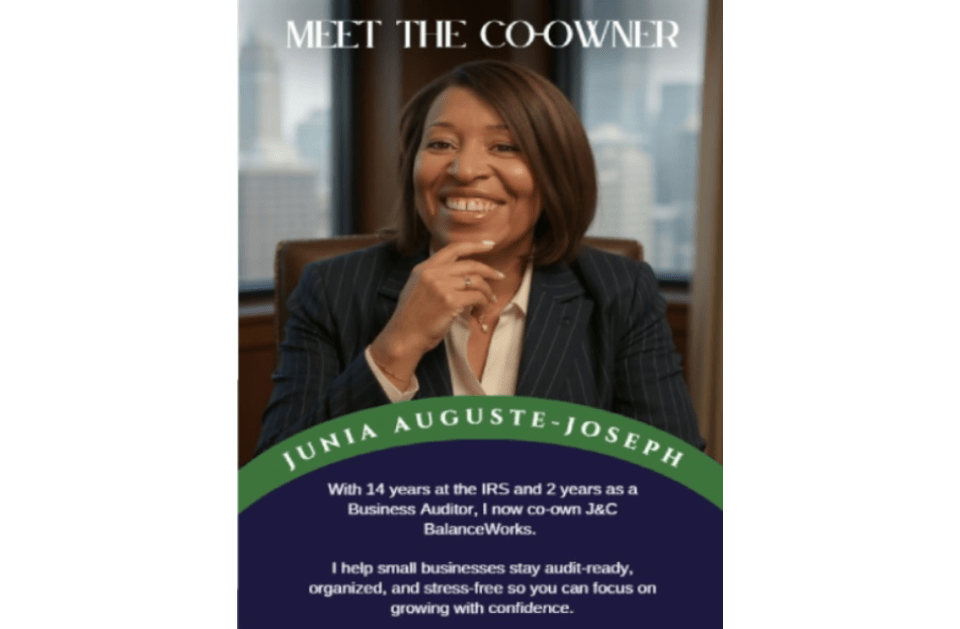

Meet The Experts Behind J&C BalanceWorks

Junia

I spent 14 years with the IRS, most recently working as a Business Tax Auditor. In that role, I closely reviewed company financials to ensure taxes were reported accurately and paid correctly.

Colette

I help individuals and small business owners gain control of their finances. I specialize in bookkeeping service, tax preparation, and personalized guidance as a dedicated tax consultant.

What Customers Are Saying

Gallery

IRS Services & Compliance in Massachusetts

At J&C BalanceWorks, we assist individuals and businesses in Massachusetts with all matters related to the Internal Revenue Service (IRS). Whether you need help understanding federal tax obligations, responding to IRS notices, or preparing correct filings, our experienced team ensures compliance and peace of mind. We help clients navigate IRS rules — minimizing risks and maximizing accuracy.

FAQs

What areas does J&C BalanceWorks serve?

We proudly serve businesses in Lowell, Boston, all of Massachusetts, and New Hampshire. We also work with clients anywhere in the U.S. through secure virtual bookkeeping.

Do you offer virtual or remote bookkeeping?

Yes! J&C BalanceWorks provides 100% virtual bookkeeping for clients across Massachusetts, New Hampshire, and nationwide. You can upload documents securely, and we handle the rest.

What services do you offer?

We provide monthly bookkeeping, tax preparation, QuickBooks Online setup, cleanup services, reconciliations, financial reporting, and small-business consulting. We help businesses stay organized, accurate, and IRS-ready.

What industries do you work with in Massachusetts and New Hampshire?

We work with cleaning companies, contractors, roofers, restaurants, therapists, property management firms, salons, e-commerce stores, consultants, and other service-based businesses throughout MA and NH.

What makes J&C BalanceWorks different?

We’re led by a former IRS Revenue Agent with 14+ years of experience, which means your books are handled with expert accuracy, compliance, and audit-ready standards. We bring big-firm knowledge with small-business care.

Can you fix messy or behind bookkeeping?

Absolutely. We specialize in QuickBooks cleanup for Massachusetts and New Hampshire small businesses, including past-due reconciliations, uncategorized transactions, and account corrections whether you’re 1 month or 2 years behind.

Do you offer tax preparation?

Yes. We provide business tax preparation for clients whose bookkeeping we manage. Keeping everything under one roof ensures accuracy and a stress-free tax season.

How do I find a local trusted IRS expert near me in Massachusetts?

To find a trusted IRS expert near you in Massachusetts, look for professionals with experience handling IRS notices, audits, and compliance matters. A reliable local expert should have strong credentials, positive client feedback, and in-depth knowledge of federal and state tax regulations.

How much do your bookkeeping services cost?

Our monthly packages typically range from $300–$3,000+ based on your number of transactions, bank accounts, and business complexity. Custom quotes are available for businesses in MA, and NH.

Do you offer catch-up bookkeeping for year-end?

Yes! We help small businesses get caught up quickly especially those in Massachusetts and New Hampshire preparing for tax season. We can bring your books current even if they haven’t been touched all year.

Can you help set up or fix QuickBooks Online?

Yes. We offer QuickBooks Online setup, troubleshooting, account syncing, and training. Many clients come to us after struggling with bank feed issues, miscategorized transactions, or incorrect setup.

How can I schedule an appointment with you?

You can call 978-200-3331, message us directly on Google, or book a consultation through our website. We offer flexible scheduling for clients in MA and NH.

Why is bookkeeping important for my business?

Bookkeeping helps you understand your profit, cash flow, expenses, and overall business health. Accurate books help you make smarter decisions, stay compliant, and be fully tax-ready.

Do you offer services to new or small businesses?

Yes! Whether you’re a brand-new startup or an established business, we help you set up strong financial systems, understand your numbers, and grow with confidence.

Do you work with nonprofit organizations?

Yes, we assist nonprofits with bookkeeping, categorization of restricted vs. unrestricted funds, QuickBooks setup, and financial reports required for compliance.

How does J&C BalanceWorks help businesses grow?

We provide clear financial reports that show where your money is going, identify areas to save, and help you plan for taxes. Clean books lead to better decisions, better profits, and better growth.

Local IRS Expert Near You, Serving Massachusetts

If you’re dealing with IRS notices, compliance issues, or federal tax concerns, our local IRS experts proudly serve clients across Massachusetts. We assist with IRS correspondence, tax resolution, audit support, and ongoing compliance, ensuring your matters are handled accurately and professionally with local expertise you can trust.